Challenges in Corporate Governance: Lessons from Uni-President Enterprises’ Investment in PChome

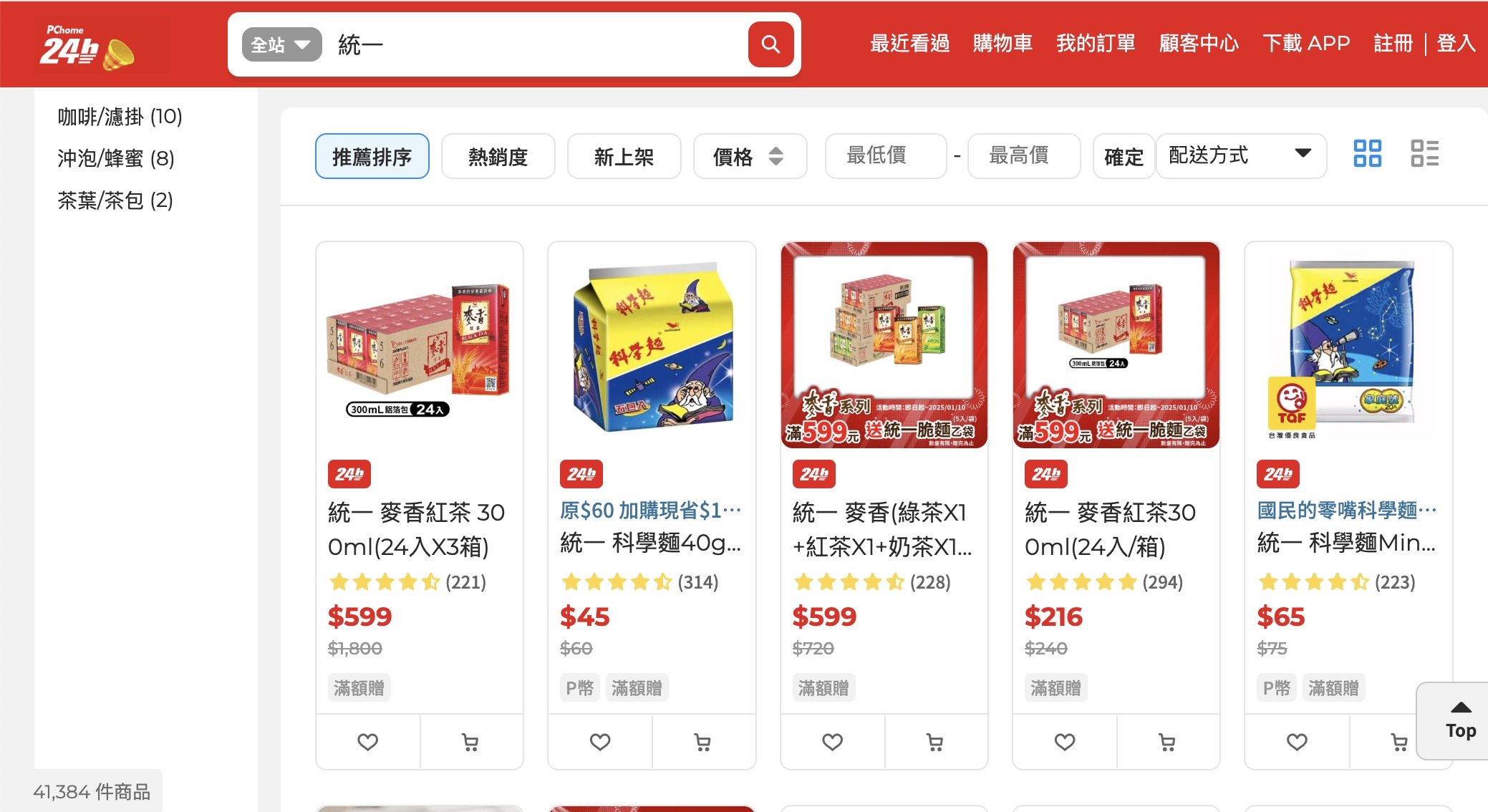

PChome Online Inc. (8044) issued a material announcement on December 19, 2024, stating that an extraordinary shareholders’ meeting held on that day approved a private placement of common shares, proposing to issue no more than 61,694,120 common shares through private placement, with Uni-President Enterprises Corporation as the subscriber. According to media reports, after completion of the private placement, Uni-President will hold approximately 30% of shares, becoming PChome’s largest single shareholder. PChome Chairman P.K. Tsai told media that the company’s private placement plan was based on funding needs and share dilution considerations. According to the private placement agreement, they will assist the Uni-President Group in obtaining 2 board seats to jointly execute corporate governance tasks in the future. When asked by media what sparks this might create in the future, Chairman Tsai said they would only know after Uni-President enters the board.

The “corporate governance” that Chairman Tsai mentioned for joint execution refers to the systems and principles that regulate company operations, aimed at ensuring companies operate efficiently and protecting the rights of all stakeholders, including shareholders, employees, customers, suppliers, creditors, society, and the environment. The goal of corporate governance is to reasonably arrange and protect the rights of shareholders and various stakeholders, promote transparency and accountability, and while enhancing operational efficiency and creating value, promote the company’s sustainable development and achieve synergistic growth of economic and social benefits.

Since the board of directors is the core institution of corporate governance, major matters such as company operational decisions, supervision and internal control, appointment and evaluation of management, disclosure of company financial and business information, and related party transactions are all resolved by the board. Particularly after Taiwan introduced independent directors and audit committees under the Securities and Exchange Act, listed and over-the-counter companies no longer establish supervisors—their functions have been replaced by audit committees composed of independent directors. The structure of the board determines corporate governance’s decision-making ability, transparency, supervisory effectiveness, and balance of interests. PChome’s board currently consists of nine directors, including six general directors and three independent directors. Although Uni-President obtaining two board seats at PChome may seem to represent only two-ninths, the board also includes institutional directors from other professional investment institutions and three independent directors. These two seats will change the power structure of corporate governance and influence the company’s operational decision-making direction. After the Uni-President Group joins PChome’s board, major corporate governance challenges that may arise include:

- Adjustment of Board Operations

With Uni-President Group becoming PChome’s largest shareholder and obtaining two board seats, the first impact will be on board operations. Corporate governance emphasizes the balance of rights and obligations among stakeholders. After Uni-President Group joins the board, the board’s existing proposal, communication, and consensus-forming operational methods must all adjust to accommodate this heavyweight member.

- Cooperation Between Management Teams

Large groups’ management teams can generally be divided into teams responsible for investment management and teams responsible for business operations. Uni-President Group obtaining two board seats represents that Uni-President will have a certain degree of influence in PChome’s board. If Uni-President Group just wants to be a happy investor, the business operations team need not be involved. However, Uni-President Group itself already owns substantial e-commerce business. Investing in PChome and holding 30% shares is clearly a strategic investment, and developing cooperation between PChome’s business and the group’s existing business should be reasonable. Therefore, how to coordinate the operations of both parties’ business operations teams, how to reach consensus in the decision-making process, and have PChome’s board pass corresponding proposals as the basis for executing cooperation projects will be a major challenge.

- Allocation of Company Resources

In strategic investment projects, investors need to effectively integrate both parties’ resources and coordinate operational directions to enhance overall value. The integration process initially involves strategic integration and cultural integration. Further integration includes asset and business integration, financial and systems integration, risk management integration, and organizational integration resulting from various integration work. After Uni-President Enterprises invests in PChome, how to effectively integrate resource allocation starting from obtaining two board seats and ensure consistency with corporate governance principles and goals is also a major challenge.

- Legal Compliance for Related Party Transactions

After Uni-President Group’s investment, there may be more business dealings between PChome and Uni-President Group. Related party transactions are not prohibited by law; appropriate related party transactions can better leverage group management synergies and enhance operational benefits. However, ensuring the fairness and transparency of these transactions is an important issue. The Company Act has requirements for voting recusal and information disclosure for related party transactions. Under the Securities and Exchange Act, related party transactions will be overseen by audit committees composed of independent directors. PChome must ensure that when conducting related transactions, it complies with relevant regulations to protect the interests of the company and shareholders.

If we look at corporate governance from the perspective of equity ownership percentage: when investors acquire 10% of a company’s shares, unless the company’s shares are extremely dispersed, as a 10% shareholder, they usually have no direct control and find it difficult to deeply intervene in the company’s operations and decisions. Corporate governance issues may focus on protecting minority shareholder rights. As for acquiring more than 50% of a company’s shares, this usually confers substantial control and will obtain the right to operate the company. The focus of corporate governance will be protecting “other” minority shareholder rights. Acquiring 30% shares is an interesting number. Although less than one-third, unless the company has another controlling major shareholder, 30% shares can already have considerable influence on board composition, major investments, and operational strategies. The vertical and horizontal alliances among various shareholder factions will be the biggest variable in corporate governance.

Uni-President Group obtaining 30% of PChome shares and two board seats and becoming PChome’s largest single shareholder presents corporate governance challenges mainly from how, after Uni-President Group joins, to establish communication and coordination mechanisms in decision-making, operations, resource allocation, etc., with the original shareholding management team and professional investment institutions, and under the supervision of independent directors, ensure that corporate governance mechanisms can operate effectively to protect the rights of all stakeholders. What will happen with this investment case that the industry is watching? As Chairman Tsai said, they will only know after Uni-President enters the board. Let’s all wait and see.