Trademark Infringement? Personal Data Leakage? Discussing Descriptive Fair Use of Trademarks and Personal Data Rights in Light of the Life Insurance Association’s Protest Statement Against Huibao Technology’s Use of “Insurance Passbook”

According to reports, when “Huibao Technology” under the Industrial Technology Research Institute (ITRI) announced its integrated AI insurance claims calculation platform service, it claimed that its platform integrated the “Insurance Passbook.” On December 26, 2024, the Life Insurance Association issued a four-point statement emphasizing that “Insurance Passbook” is a professional service platform jointly developed by the Life Insurance Association and insurance companies and obtained trademark registration on January 1, 2024. Any unauthorized institutions or platforms may not use this name. Moreover, the use of Insurance Passbook data requires explicit authorization from the public for the association to use within a specific scope, and the public has never authorized the Life Insurance Association to provide data to “Huibao Technology.” The association demanded that “Huibao Technology” immediately cease false publicity and publicly correct and explain within three days. Let’s first look at the following news report:

[Huibao Technology’s AI Platform “Insurance Passbook” Angers Life Insurance Association, Company Issues Apology]

ETtoday Finance Cloud Reporter Chen Ying-Xin / Taipei Report

Huibao Technology under ITRI claims to use AI technology to provide integrated policy and claims calculation services, attempting to capture the trillion-yuan business opportunity. Unexpectedly, this sparked the Life Insurance Association’s dissatisfaction, urgently shouting “The Life Insurance Association and industry members have joint patents” and “We have never authorized data to Huibao Technology.” Huibao Technology urgently issued a 3-point statement today (27th), emphasizing that it has never claimed to the public any form of cooperation or system connection with the Life Insurance Association and expressed apologies to the association and ITRI.

The Life Insurance Association pointed out that Insurance Passbook is a professional service platform jointly developed by the Life Insurance Association and insurance companies and obtained trademark registration on January 1 this year. Any unauthorized institutions or platforms may not use this name.

Additionally, the Life Insurance Association stated that the use of Insurance Passbook data requires the public to register and upgrade to platinum membership before explicitly authorizing the association to use within a specific scope, and the public has never authorized the association to provide data to “Huibao Technology.”

Huibao Technology issued a statement emphasizing three points: First, how to quickly understand claim amounts and protect one’s rights is a common consumer need. Startup Huibao Technology created Taiwan’s first AI claims calculation platform, providing insurance companies with estimates of claim amounts for policyholders.

Second, Huibao Technology’s “Yiqifu” system obtains insurance lists from within users’ Insurance Passbooks through public authorization, then imports them into the “Yiqifu” system for integrated calculation and health checks.

Third, Huibao Technology has never claimed to the public any form of cooperation or system connection with the Life Insurance Association, causing trouble for the association and ITRI, and expresses apologies and hereby clarifies.

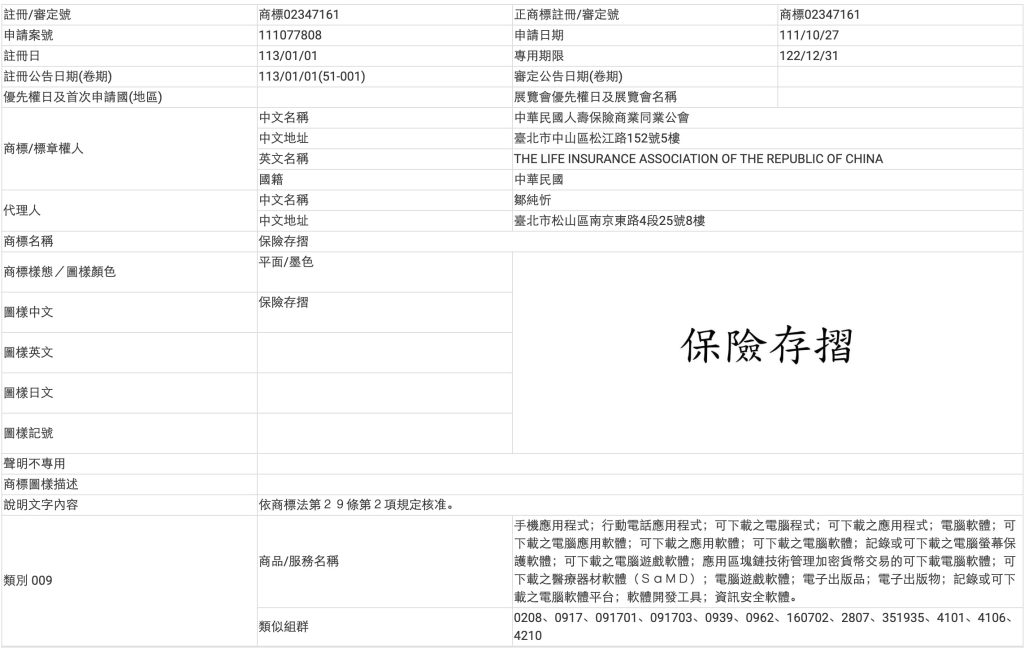

First, let’s look at the trademark registered by the Life Insurance Association. What the author finds interesting is that the Life Insurance Association truly registered a “trademark” rather than a “collective trademark.” Therefore, unless the Life Insurance Association separately authorizes other life insurance companies to use the “Insurance Passbook” trademark, even member insurance companies of the Life Insurance Association, or even insurance companies mentioned in the press release as participating in joint development, cannot use “Insurance Passbook” as a product or service name or for marketing purposes—not just Huibao Technology, which has no cooperative relationship.

Second, readers may also notice why functional and descriptive text like “Insurance Passbook” can be registered as a trademark. In fact, the above trademark registration information also reveals clues—the description text field notes “Approved according to Article 29, Paragraph 2 of the Trademark Act.” Article 29 of the Trademark Act stipulates: “I. A trademark that falls under any of the following circumstances of lacking distinctiveness shall not be registered: 1. Consisting solely of descriptions of the quality, use, raw materials, origin, or related characteristics of the designated goods or services. 2. Consisting solely of common marks or names of designated goods or services. 3. Consisting solely of other non-distinctive signs. II. If circumstances under Item 1 or Item 3 of the preceding paragraph exist, but through the applicant’s use, the mark has become an identification mark for the applicant’s goods or services in trade, this shall not apply. III. If a trademark pattern includes non-distinctive parts and may cause doubt about the scope of trademark rights, the applicant should declare that part not exclusive; if no declaration of non-exclusivity is made, it shall not be registered.” In other words, indeed, text like “Insurance Passbook,” if generally applied for trademark registration, should be considered as “merely describing characteristics of designated goods or services” and “consisting solely of other non-distinctive signs” under Article 29, Paragraph 1, and unable to be registered as a trademark. However, because the Life Insurance Association first began using the service name “Insurance Passbook” and actively promoted it, providing relevant evidence to convince the Taiwan Intellectual Property Office that “Insurance Passbook” has been recognized by relevant consumers as a service launched by the Life Insurance Association—just like “Let’s Talk in English”—it can exceptionally be registered as a trademark under Article 29, Paragraph 2. This is commonly called “acquired distinctiveness,” also known as “secondary meaning,” meaning that for marks lacking inherent distinctiveness, through continuous and meaningful human use, they acquire acquired distinctiveness and may be registered as trademarks.

Next, let’s discuss: after the Life Insurance Association registered the “Insurance Passbook” trademark, can others really not use the text “Insurance Passbook” at all without the Life Insurance Association’s authorization? Of course not. Article 36, Paragraph 1, Item 2 of the Trademark Act stipulates: “The following circumstances are not bound by others’ trademark rights: … 2. Using others’ trademarks in a manner consistent with honest commercial practices to indicate the purpose of use of goods or services, where it is necessary to use others’ trademarks to indicate those persons’ goods or services. However, if the use results in likelihood of confusion or mistake among relevant consumers, this shall not apply.” The most commonly asked situation in practice is when e-commerce operators want to hold promotional activities, using the iPhone 16 as a lottery prize and mentioning “buy to draw iPhone 16” on the lottery page and related promotions. We all know iPhone is Apple Inc.’s registered trademark, and Apple Inc. clearly declares such lottery and promotional use is not permitted, but can it really not be done? Apple Inc.’s dislike of others riding on its trademark is correct, but the Trademark Act actually allows disclosure of prize information in lottery activities and explicit mention of others’ trademarks because this is necessary to indicate others’ goods—it belongs to indicative fair use. However, there must not be likelihood of confusion or mistake among relevant consumers. Therefore, when organizing related lottery activities, one can often see special notations like “not affiliated with Apple Inc.” This news event about the Life Insurance Association’s dispute with Huibao Technology over using “Insurance Passbook” is the same. Actually, Huibao Technology only needs to appropriately clarify that it has no cooperation with the Life Insurance Association for data connection but rather receives relevant policy data stored in users’ “Insurance Passbook” “extracted” by individual users themselves and provided to Huibao Technology’s platform for AI computation and generation of recommendations.

Finally, let’s discuss what the Life Insurance Association mentioned in its statement: the use of Insurance Passbook data requires the public to register and upgrade to platinum membership before explicitly authorizing the association to use within a specific scope, and the public has never authorized the association to provide data to “Huibao Technology.” If we observe from the perspective that insurance policy data belongs to personal data, personal data, as a representative right of information privacy, is a “personality right” in nature. Therefore, the public does not “authorize” personal data to the Life Insurance Association but only “consents” to the Life Insurance Association collecting and processing and using within the necessary scope for the specific purpose of “Insurance Passbook” service. For such legal acts of non-property rights nature, using “consent” is more appropriate. The Personal Data Protection Act also uses the term “consent.” This personal data is not “owned” by the Life Insurance Association after collection (in fact, data itself is not a tangible object and is not suitable for interpretation using ownership concepts) but still belongs to the public’s personal data. The Life Insurance Association cannot decide whether this data can be accessed by Huibao Technology—only the public themselves can decide. That is, this news event actually does not involve the Life Insurance Association’s claimed risk of personal data leakage because Huibao Company cannot directly obtain data from the Insurance Passbook platform itself but needs users to obtain data themselves. The public has the right to decide to whom to provide relevant insurance data. Even uploading to the “Insurance Passbook” platform does not require the Life Insurance Association’s consent. Indeed, as stated in the Life Insurance Association’s statement, without separately obtaining public consent, the Life Insurance Association naturally cannot provide it to Huibao Technology. We can also understand why the Life Insurance Association must clarify that there is no connection with Huibao Technology, because if there were, the Life Insurance Association would violate the Personal Data Protection Act and should naturally clarify the facts.

Overall, Huibao Technology’s use of the term “integrating” Insurance Passbook in this press release was indeed inappropriate, but press releases, especially verbal explanations, do need to use more understandable and marketing-effective wording. Inevitably, there’s some sense of riding on the Life Insurance Association’s long-term promotion of Insurance Passbook service to attract public use of its products, and clarification should be made to avoid misunderstanding. But legally, if when actually providing services, there is clear indication that users independently log into their “Insurance Passbook” accounts, extract relevant insurance policy data, and then import it into Huibao Technology’s platform, even if using the text description “Insurance Passbook” when promoting, it is legal under trademark law. As for personal data issues, whether for the Life Insurance Association or Huibao Technology, they are important data governance issues. Personal data, as part of personality rights, is not suitable for using “authorization.” The Life Insurance Association obtains users’ “consent” to legally collect, process, and use personal data according to law, but this does not mean obtaining “authorization” to use this data, because personal data is not property rights. Subsequently, any other person needing to use this insurance data, whether Huibao Company or other life insurance companies, must legally obtain the parties’ consent according to law (or other circumstances where personal data may be legally collected, processed, and used according to legal provisions). It cannot be completely transferred or authorized like property rights models to obtain rights to use such data. This is also a legal compliance issue that companies must pay attention to when planning data governance.